Income Tax Calculator (Aussie & NZ)

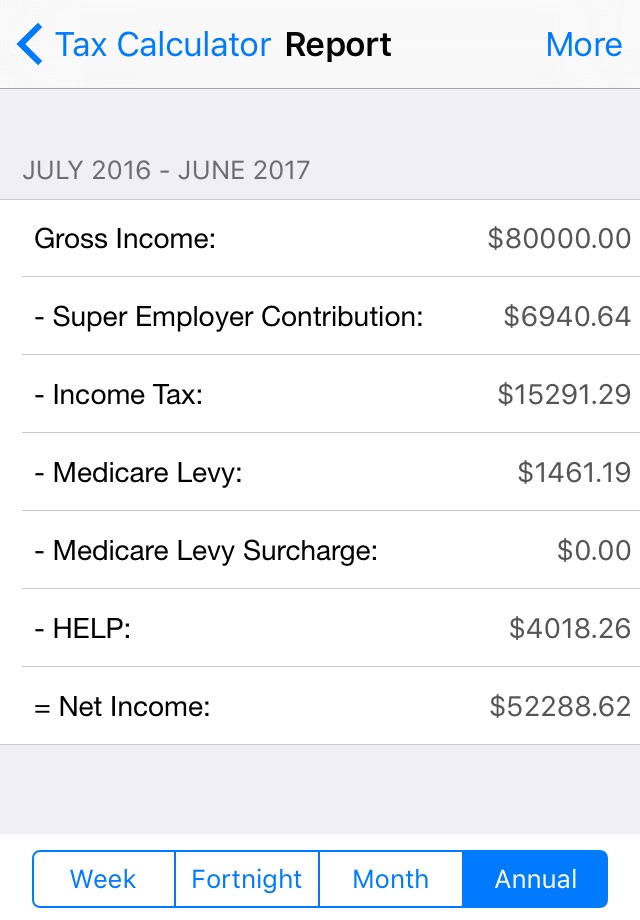

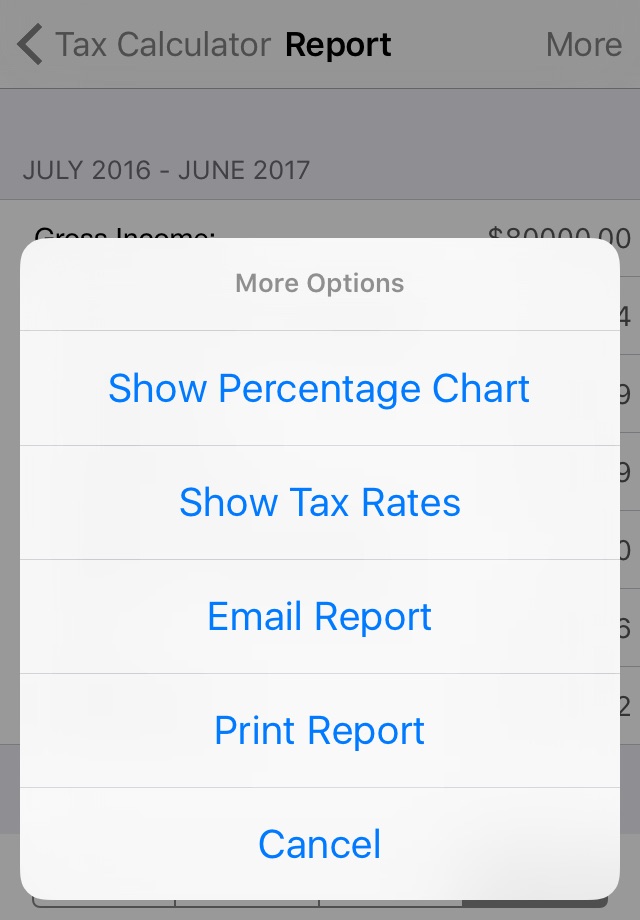

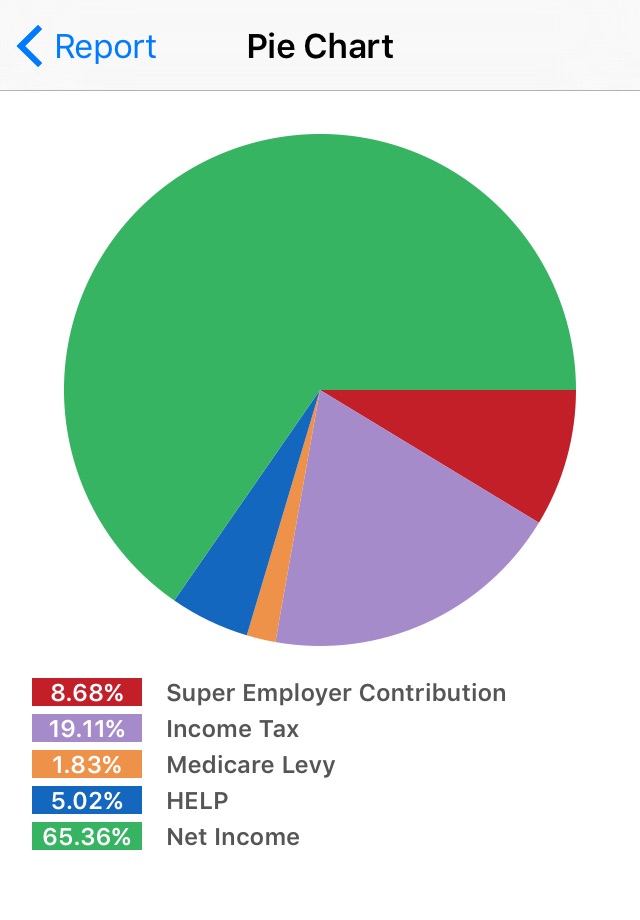

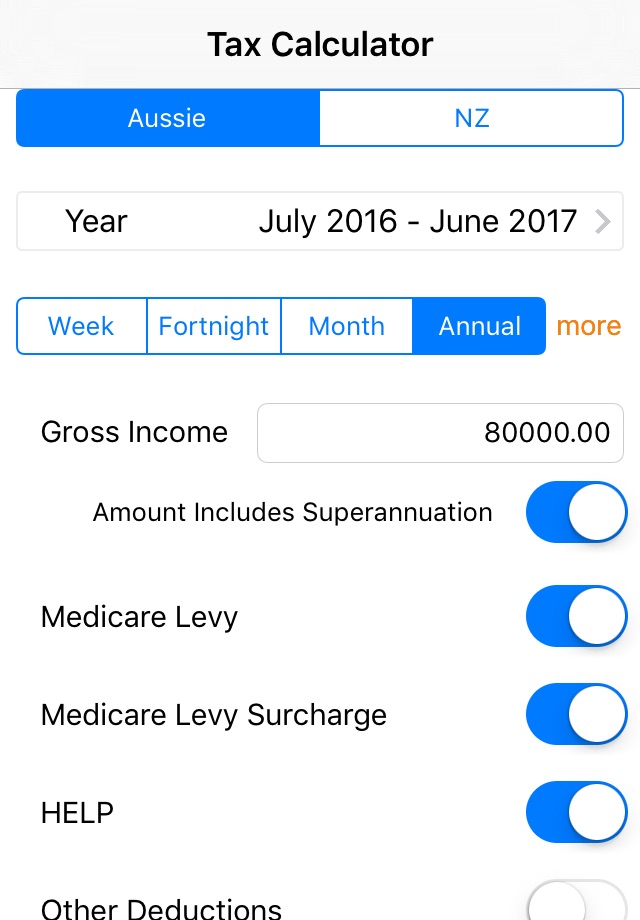

Both iPhone and iPad user interface redesigned to make it even easier to use. It also includes the latest tax rates plus many fantastic features: print, email report, view pie chart, supports percentage calculation for your other deductions. Its just so fast and easy to use, and gives the results exactly what you want. Very small app size, even less than 1MB only 853KB, save your data and space.

This is the number one income tax calculator on the App store which supports tax calculations for both Australia and New Zealand. Its the best way to calculate the income tax for both Australia and New Zealand.

This calculator is very powerful. Simply enter several key details about your situation and the application will calculate:

For Australia

- Income Tax

- Medicare Levy

- Medicare Levy Surcharge

- HELP

- Low Income Tax Credit

- Net Income

For New Zealand

- Income Tax

- Acc Earners Levy

- KiwiSaver

- Student Loan

- Low Income Tax Credit

- Net Income

Features in this application

- Uses official tax data from Australian Taxation Office and New Zealand Inland Revenue.

- Easy to read income tax report on a weekly, fortnightly, monthly and yearly basis.

- Super easy to compare the tax rates between Australia and New Zealand.

- Medicare Levy, Medicare Levy Surcharge, HELP repayments calculations for Australia.

- Acc Earners Levy, KiwiSaver, Student Loan repayments calculations for New Zealand.

- Low Income Tax Credit calculations.

- Tax threshold and rates displayed.

- Includes the latest tax data for the current tax year, and for prior tax years all the way back to 2007/2008.

If you have ideas for features or improvements youd like to see in the next version, please email [email protected]. Thank you!

We take extremely care of accurate results, however, please note calculations should be considered indicative only and not as professional tax advice specific to your circumstances.